| Britains lost decade |

| |

Brexit, Covid and the war in Ukraine, events that have damaged Britains economy. was the real nail in Britains fiscal policy AUSTERITY, which is getting ready to return |

|

|

London, one of the worlds capitals of global finance, is one of the wealthiest urban areas in the world. Its economy is worth roughly £508 billion, ($652 billion U.S.). If it were an independent state, London would rank as the 22nd largest economy in the world. However, London's and the surrounding counties are atypical for the country. This small area makes up nearly half the UK's GDP, while having a quarter of its population. If one was to amputate London's output, it would reduce British living standards by 14%, just enough to slip ahead of the US state of Mississippi. Yeah, the UK has seen better days. The last ten years have been particularly tough. While real disposable income, has remained almost unchanged. Compared to a decade ago, the cost of goods and services has shot up; meanwhile productivity is low, one of the lowest of any major economy. Housing has become almost unaffordable, rising by more that £2,200 in a single month alone. The UK now holds the record for the highest number of homeless people in the developed world. Analysts are split on the root causes for Britain is getting poorer, and doing so on a far faster rate than the rest of the worlds leading economies. ith most pointing Brexit, Covid or the war in the Ukraine. The largest factor could be aother policy, one tats getting ready to return, Austerity. The hows and why arent that complex. But as with most things the devi is in the detail!

Britain has stumbled its way through a number of setbacks. Britain now faces a crisis of epic proportions, with no quick fix in sight. When you think about it, it's ironic. The UK was the first country to industrialize. Now its set to be become the first to de-industrialise. A number of factors has pushed the UK economy into an ever decreasing circle. How has this happened, lets getting into it. |

|

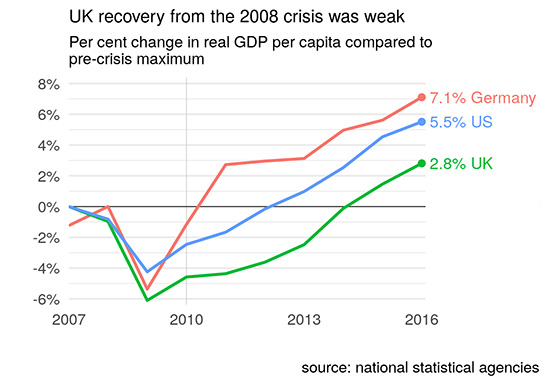

| Chancellor George Osbourne opted for Austerity measures following the 2008 financial crisis, choosing to cut spending and investiture |

Not long ago, Britain was considered one of the world's most prosperous nations, a prime destination for skilled professionals seeking to advance their careers. Today, not so much. The state is under incredible socio-economic strain, much more so than people realize. Three Back to back geopolitical shockwaves have left it with a colossal debt, Brexit, COVID and the war in Ukraine. The catalyst however, dates to back 2008 financial crisis, and the political decisions that followed it. Like everyone else, Britain was deeply injured. But the way it handled the fallout set it apart from the rest of the developed world. After borrowing roughly £141 billion to bail out British banks, the government opted for austerity measures. Instead of taking advantage of near 0% interest rates, and investing in fiscal and social policies.There were no significant tax cuts or minimum wage increases. No inflation control, no housing assistance, no job creation programs. You get the point.

|

|

| Lack of investment following the crisis, compared to other leading economies left the UK exposed should another crisis take place |

For ordinary citizens, the consequences were devastating. Real household income dropped and then flatlined for the next 15 years. In economic terms, this is known as a lost decade. In the years following, the deficit grew substantially. Today, British households sit 20% behind Norway and 16% behind the US in terms of real income. This drop in living standards is felt vividly among the middle class. Real household income is a fundamental driver of economic activity. It encourages consumer spending and improves living standards, all of which contribute to economic growth.

In Britain, however, the government prioritized corporate interests above all else. But even in the corporate world, the gains were mostly short term. The productivity rate was left on the back burner, with no significant measures taken to try and stop the rot. Instead, the government has chosen to bury its head in the sand. |

|

| Countries such as Taiwan, invested in their economies during the austerity years, with Britain choosing the opposite approach |

For context, increasing productivity is one of the most efficient ways to grow an economy. But contrary to popular belief, improving productivity does not mean working harder. Instead, the point should be to boost economic output without increasing the amount of work. So when an agriculture driven economy switches to manufacturing microchips, productivity increases because the tech industry is more profitable and has greater margins. Ergo, the workforce is getting more out of it for the same amount of labour. That's why the Japanese government invested in turning farmland into factories during the same period. It adds to productivity, and ultimately improves the economy.

In the UK following the crisis, productivity output per capita spiralled, due to a lack of investment. A report by the London School of Economics puts things into perspective. Before the crisis, productivity was growing at nearly 2% annually. After the crisis, however, it weakened substantially, changing a trend that had been in motion since the 1980s. The British workforce now has the second lowest productivity rate among the G7 economies, whereas before the 2008 crisis it was second only to the US. The simultaneous effects of sluggish real household income and low productivity, explain a lot about the performance of the British economy. It is essentially fighting for its life.

|

|

| The government had no plans ready should britain vote to leave the EU, so the UK borrowed £280 billion, adding to the national debt |

Britain's lost decade happened so casually, so indifferently that none of its political parties acknowledged it, let alone addressed it. There was no political discourse on a subject that was affecting millions of households. But it was a crisis nonetheless. And so the discourse expressed itself in the form of Brexit. However, the uncertainty surrounding Brexit made a bad situation even worse. It had a sharp effect on foreign investment. According to the Bank of England, Brexit reduced investment by 25%. What's more, soon after Brexit, the onset of COVID exacerbated the economic crisis that was brewing. The government stepped in and borrowed an additional £280 billion in its response to the Corona virus. This was deemed necessary to get the nation through the pandemic. |

|

| During Covid interest rates at 0.1%, repayments on the national debts seemed managable provided there wasnt another crisis |

But here's the thing. Most of the COVID bailout was borrowed when interest rates were at an historic low. Sitting at around 0.1% at the time, repayments were expected to be relatively manageable. And this might have been true were it not for the final nail in the coffin, The war in Ukraine. The minute the war began, access to Russian oil and gas was halted by sanctions and trade restrictions. The energy crisis that followed sparked a cost of living jumped across Europe. The crisis hit closest to home; British households were forced to pay three times the usual price, just to heat their homes during the winter. Much of the public grew anxious. So the Government intervened again. This time it was one of Europe's most generous packages of financial support. Between £60 and £100 billion in additional spending went straight into Britain's debt.

The damage to households was mild, but the bailout gave the UK its biggest increase in debt as a share of its GDP. Inflation rates rose to new highs. In response, central banks ramped up interest rates, which resulted in mortgage payments going up by hundreds of pounds overnight. Meanwhile, for the government, the high interest rate added additional billions to the national debt.

And while before debt repayments were believed to be relatively manageable before. After the energy crisis that became increasingly expensive to pay off. Debt repayments jumped from £40 billion per year to about £100 billion per year, a staggering £60 billion increase in spending. A sum roughly the size of the entire British defence budget. So yeah, although admirable, Britain's support to Ukraine has essentially broke its economy. |

|

| the Ukraine war sparked an energy and cost of living crisis, which has essentailly pushed Britains economy passed the tipping point |

So the consequences go full circle. Usually a drive to get people back to work happens when there are jobs to put people into. The Labour leadership are determined to get people off benefits and back to work. The fact that job vacancies are low everywhere but London hasn’t factored into their thinking. But one thing is clear, Austerity is back, and not by design.

Last time the country went down this road the country was part of the European Unoin, which was essentially a fail safe in case in case of a crisis. Let us hope here that another unforseen disaster doesnt happen. Or Britain may witness the biggest ladder-upping exerciseby our neighbours, since we shamefuly abandoned the commonwealth in favour of closer shores. |

| |

| |

|

|

|

|